In a world of ever-present marketing messages and financial pressures, the feeling of not having enough can distort judgment, fuel anxiety, and lead to costly mistakes. Understanding how scarcity influences our minds is the first step toward breaking free from its traps.

Definition and Foundation of Scarcity Psychology

The scarcity principle states that humans value items or information more when they perceive them as limited or rare (Cialdini, 2009)[1][3]. This principle is rooted in both social psychology and classical economics, where limited resources collide with unlimited human wants.

As a mental shortcut known as a heuristic, scarcity can cause us to overvalue scarce resources including money and time, often ignoring broader context or long-term consequences. Social proof and loss aversion amplify these effects: seeing others chase a limited offer or fearing missing out triggers impulsive actions.

Scarcity Mindset and Its Effects

A scarcity mindset is a chronic perception of never having enough money or time, leading to persistent anxiety and a narrowed focus on immediate needs[10][11]. Neuroscientific research using fMRI reveals that under scarcity, activity spikes in the orbitofrontal cortex—our valuation center—while engagement in the dorsolateral prefrontal cortex—responsible for planning and self-control—drops significantly[8].

This neural shift explains why people in scarcity often opt for high-interest loans or quick rewards over larger, delayed benefits. Studies indicate present-biased choices increase by up to 30% under perceived scarcity, while savings rates dip dramatically[8].

Psychological Mechanisms Underlying Scarcity

- Loss Aversion: The fear of losing something often outweighs the potential joy of an equivalent gain (Kahneman & Tversky). This drives FOMO and urgent buying.

- Impulsivity in decision-making: Limited-time offers and countdown timers exploit our instinct to act fast rather than wisely[6][12].

- Psychological Reactance: When choices feel restricted, desire for the forbidden intensifies, pushing us toward scarce goods[1].

- Social Proof Amplification: Seeing others compete for a resource inflates its perceived value, fueling herd behavior in markets[3].

Financial Behaviors and Traps Driven by Scarcity

Under scarcity, short-termism overtakes long-term planning. Individuals may accept lower payouts now rather than waiting for more later, simply to meet urgent needs such as rent or food[2].

This mindset manifests in two opposing behaviors: compulsive hoarding of cash—often stashed in low-yield accounts—and impulsive spending on quick fixes, like retail therapy or payday loans, to momentarily ease stress[6][10].

Moreover, poor risk assessment emerges: some under-savers swing to extreme caution, while others chase high-risk, high-return “get rich quick” schemes out of desperation or FOMO[12].

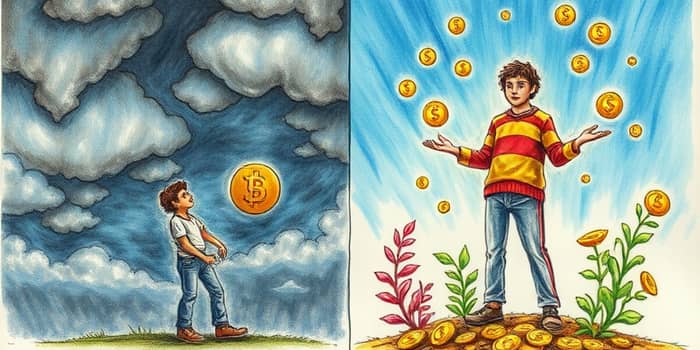

Scarcity vs. Abundance Mindset

Strategies to Avoid Scarcity-Induced Financial Traps

- Pause Before Acting on Urgency: Recognize emotional triggers and introduce a cooling-off period for major purchases[1].

- Automate Savings and Investments: Set up automatic transfers to protect long-term goals from impulsive decision-making[10][12].

- Reframe with Abundance Thinking: Practice gratitude exercises and focus on future opportunities rather than immediate deficits[4][6].

- Educate Yourself on Marketing Tactics: Learn how scarcity messaging manipulates choices, and resist countdown timers and “only X left” cues[5].

- Seek Professional Advice: A financial advisor can help design robust strategies aligned with your values and goals[12].

Conclusion

Scarcity psychology is a powerful force that shapes our financial choices, often steering us toward traps of impulsive spending or excessive caution. By understanding its roots in cognitive biases and neural shifts, we gain the power to recognize scarcity-driven impulses and reorient toward an abundance mindset.

Implementing simple strategies—mindful pauses, automated plans, and gratitude practices—can break the cycle of urgency and help build resilience. Ultimately, learning to navigate scarcity thoughtfully not only safeguards your financial health but also fosters a sense of security and empowerment for the future.

References

- https://psychotricks.com/scarcity-principle/

- https://www.apa.org/news/press/releases/2023/09/financial-scarcity-decision-making

- https://en.wikipedia.org/wiki/Scarcity_(social_psychology)

- https://www.launchthedamnthing.com/blog/scarcity-vs-abundance-mindset

- https://www.wealest.com/articles/scarcity-principle

- https://abacuswealth.com/transforming-your-money-mindset-shifting-from-scarcity-to-abundance/

- https://www.apa.org/monitor/2014/02/scarcity

- https://pmc.ncbi.nlm.nih.gov/articles/PMC6575633/

- https://news.wpcarey.asu.edu/20070214-gentle-science-persuasion-part-six-scarcity

- https://creativeplanning.com/insights/financial-planning/scarcity-mindset/

- https://www.behavioraleconomics.com/resources/mini-encyclopedia-of-be/scarcity-psychology-of/

- https://www.ametrinewealth.com/insights/scarcity-mindset-how-its-holding-you-back-financially-and-3-ways-to-reframe-it

- https://www.psychologytoday.com/us/blog/social-instincts/202501/how-the-scarcity-principle-creates-unhealthy-relationships

- https://www.wondermind.com/article/scarcity-mindset/

- https://www.webmd.com/mental-health/what-is-scarcity-mentality

- https://www.relationalpsych.group/articles/understanding-the-scarcity-money-mindset

- https://moneywithkatie.com/shifting-your-money-mindset-from-scarcity-to-abundance/